We’re proud to introduce the newest members of the PMT Law Firm team — a group of talented interns who are already making their mark this summer. Please join us in welcoming: Nyaila Elmore – Our...

Pillinger Miller Tarallo, LLP Archives

PMT Wins through Discovery and Exposes Weakness

By Paul J. Winterstein. In Lisa Montenero, As Administrator of the Estate of Paul Montenero, Deceased v. New York State Bridge Authority (Ulster County, NY Index No.: EF2023-1225 – PMT: Wrongful...

PMT Madness Bracket 2025

Let the PMT “Madness” Bracket Begin! For PMT, the NCAA Tournament has always been a special time when we celebrate the start of spring after the long winter. As many of you know, every...

PMT Winning in Court – Defendants Can Win in the Bronx

By Shawn M. Weakland. Ramon Diaz v. Giulio Darmetta and Eric R. Darmetta (Bronx County, NY Index No.: 27147/2015E – PMT: Automobile), On August 4, 2015, a two-vehicle accident occurred involving a...

PMT Employee Appreciation Day 2025

By Marc H. Pillinger, Jeffrey T. Miller, Jeffrey D. Schulman. and Richard J. Freire. We just wanted to take a moment to say a huge thank you to each and every one of you on this Employee...

PMT “Madness” Luncheon March 20th, 2025

It’s Time for Our Annual PMT “Madness” NCAA Luncheon! WHEN Thursday, March 20th, 202512:00 pm to 4:00 pmNo RSVP Required WHERE Killarney Rose 127 Pearl Street New York, NY 10005 For...

Congratulations to Robert J. Gironda who has been Promoted to Partner

By Marc H. Pillinger, Jeffrey T. Miller, Jeffrey D. Schulman. and Richard J. Freire. We are pleased to announce the promotion of Robert J. Gironda to Partner! Since joining us in 2017, Robert has...

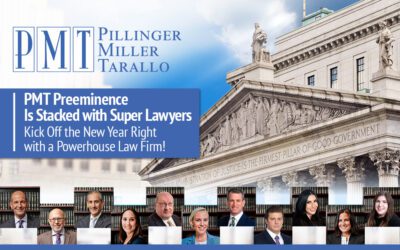

PMT Preeminence Is Stacked with Super Lawyers

PMT Preeminence Is Stacked with Super Lawyers. Kick off the New Year Right with a Powerhouse Law Firm! For over twenty years, Pillinger Miller Tarallo, LLP has served the insurance industry...

PMT Wishes You Happy Holidays

PMT Wishes You Happy Holidays and a Joyful New Year! For over twenty years, Pillinger Miller Tarallo, LLP has served the insurance industry by delivering results. The Firm provides preeminent...

Richard J. Freire has been Promoted to PMT’s Executive Committee

By Marc H. Pillinger, Jeffrey T. Miller and Jeffrey D. Schulman. We have some exciting news to share about PMT’s growth and continued success. Richard J. Freire has been promoted to PMT’s Executive...